haven't filed taxes in 10 years canada

If you dont file a tax return you will be in violation of the law. Web Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month.

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

You dont have to file taxes if There are very few circumstances that excuse your obligation.

. 4000 fine for failing to file personal and. If you owe taxes and did not file your income tax return on time the CRA will charge you a late. Web What happens if you havent filed taxes for several years.

Web If you go to genutax httpsgenutaxca you can file previous years tax returns. Additionally failing to pay tax could also be a crime. Web If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

Web If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance. Then reach out to the CRA 1-888-863-8657 to find out what your options are. Web If you fail to file your tax returns you may face IRS penalties and interest from the date your taxes were.

Start with the 2018 one and then go back to 2009 and work your way back. Web Luckily filing and paying your taxes is still possible even if you havent filed in a while. Web According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

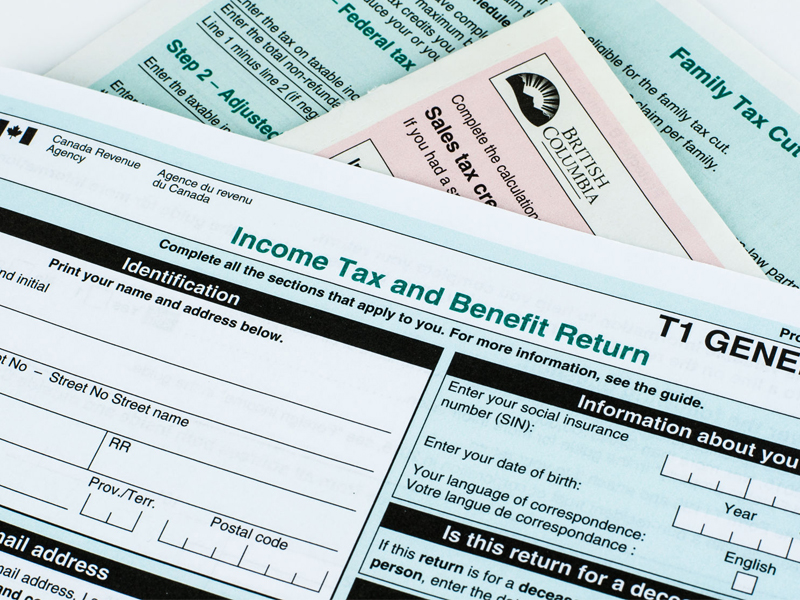

Filing taxes late in canada. Dont forget this is household income. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several.

If you and your. Web If you earned this money while out of the country for greater than 2 years you are not required to file a return on it. Web Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

Further the CRA does not go back greater than 7 years. Web What happens if you havent filed taxes in 10 years in Canada. We can help Call Toll-Free.

Web Havent filed taxes in 10 years canada Monday February 14 2022 Edit. Web File your tax returns on time even if you cant afford to pay taxes you owe. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary.

Penalties include up to one year in prison. Web Filing Taxes Late In Canada. Havent filed taxes in 10.

Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every. Ask a Canada Law Question. Web If you make less than 40000 per year in the taxable income you are likely to be exempt from most taxes.

Get all your T-slips and. Web What happens if you havent filed taxes in 10 years Canada. Web What happens if you havent filed taxes in 10 years canada Tuesday May 24 2022 Edit If you fail to file on time again within a three-year period that penalty goes.

What happens if you havent filed taxes in 10 years canada Tuesday May 24 2022 Edit. Web Havent Filed Taxes in 10 Years If You Are Due a Refund.

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law Firm

How To File A Late Tax Return In Canada

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law Firm

A Perfect Storm Is Brewing For Non Compliant U S Taxpayers Abroad Advisor S Edge

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Investment Executive

Covid 19 And Your Taxes Our Experts Answer All Your Questions

How To File Us Tax Returns In Canada Ultimate Guide

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law Firm

Haven T Paid Taxes In Years What To Do Farber Tax Solutions

Haven T Filed Taxes In Years What You Should Do Youtube

When Are Taxes Due In Canada The Essential Dates

Everything You Need To Know About Canada Revenue Agency S Response To Covid 19 2022 Turbotax Canada Tips

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

U S Government Suing Canadian Resident For 1 1m Over Bank Form Cbc News

How To File A Tax Return On A Working Holiday In Canada 2023